Courtesy: Madison

Investment Thesis:Franco-Nevada (FNV) is considered the poster child for the "streamers" such as Wheaton Precious Metals (WPM), Osisko Gold Royalties (OR), Royal Gold (RGLD), or the junior Sandstorm Gold (SAND).

The company fundamentals are solid with a potential for long-term growth, the company has no debt and pays a 1.36% dividend annually supported by free cash flow. The business model is solid with limited risk, and the company is diversifying now into the oil segment with about 7.2% of its first-quarter revenues coming from oil. Sandip Rana, the CFO, said in the conference call:

We currently have $1.4 billion of available capital, when including our credit facilities. During the quarter, we funded $90 million for the Delaware oil transaction, as well as the Cobre Panama stream addition for $356 million. The company continues to have no debt.

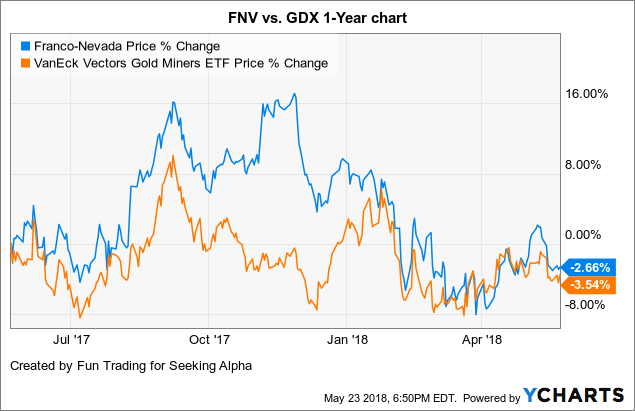

This business success has been translated by a substantial gain in the stock price with the stock almost continuously outperforming the VanEck Vectors Gold Miners ETF (GDX) since January.

FNV data by YCharts

Therefore, FNV is a stock that should be considered as a long-term investment with only sparse trading using the ups and downs of the market.

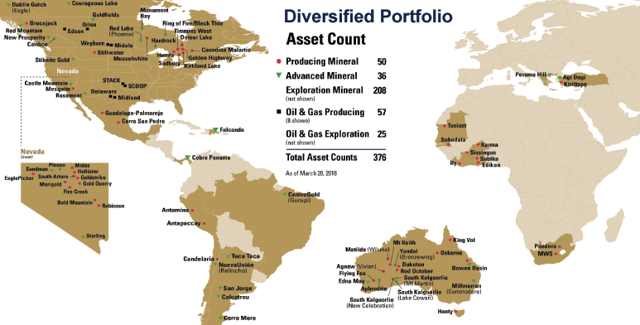

Highly Diversified Portfolio

Source: FNV Presentation May 2018

Franco-Nevada: Balance Sheet and Production in 1Q'2018| Franco-Nevada | 2Q'15 | 3Q'15 | 4Q'15 | 1Q'16 | 2Q'16 | 3Q'16 | 4Q'16 | 1Q'17 | 2Q'17 | 3Q'17 | 4Q'17 | 1Q'18 |

| Total Revenues in $ Million | 109.4 | 103.7 | 121.3 | 132.0 | 150.9 | 172.0 | 155.3 | 172.7 | 163.6 | 171.5 | 167.2 | 173.1 |

| Net Income in $ Million | 21.6 | 15.2 | ��31.4 | 30.0 | 42.3 | 54.4 | ��4.5 | 45.6 | 45.6 | 60.0 | 43.5 | 64.6 |

| EBITDA $ Million | 82.2 | 74.0 | 30.9 | 104.9 | 122.6 | 140.9 | 76.9 | 128.3 | 124.7 | 134.2 | 125.0 | 77.4 |

| Profit margin % (0 if loss) | 19.7% | 14.7% | 0 | 22.7% | 28.0% | 31.6% | 0 | 26.4% | 27.9% | 35.0% | 26.0% | 37.3% |

| EPS diluted in $/share | 0.14 | 0.10 | ��0.20 | 0.18 | 0.24 | 0.30 | ��0.03 | 0.25 | 0.25 | 0.32 | 0.23 | 0.35 |

| Cash from operations in $ Million | 78.0 | 72.4 | 88.9 | 124.0 | 103.5 | 121.6 | 121.9 | 119.8 | 126.5 | 116.0 | 126.3 | 137.5 |

| CapEx in $ Million | 2.8 | 1.7 | 68.2 | 0.7 | 1.3 | 1.8 | 2.3 | 2.0 | 1.9 | 1.8 | 499.9 | 0 |

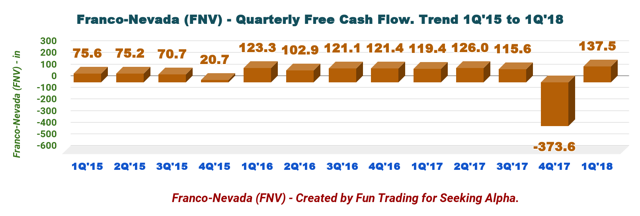

| Free Cash Flow in $ Million | 75.2 | 70.7 | 20.7 | 123.3 | 102.9 | 121.1 | 121.4 | 119.4 | 126.0 | 115.6 | -373.6 | 137.5 |

| Total Cash $ Million | 610.8 | 605.4 | 168.0 | 176.3 | 225.8 | 277.6 | 253.0 | 283.0 | 614.3 | 546.0 | 87.7 | |

| Long term Debt in $ Million | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Dividend per share in $ | 0.21 | 0.21 | 0.21 | 0.21 | 0.22 | 0.22 | 0.22 | 0.22 | 0.23 | 0.23 | 0.23 | 0.24 |

| Shares outstanding (diluted) in Million | 156.8 | 167.8 | 156.9 | 166.8 | 177.8 | 180.2 | 176.1 | 182.4 | 181.6 | 178.1 | 189.1 | 185.9 |

| GEO's | 2Q'15 | 3Q'15 | 4Q'15 | 1Q'16 | 2Q'16 | 3Q'16 | 4Q'16 | 1Q'17 | 2Q'17 | 3Q'17 | 4Q'17 | 1Q'18 |

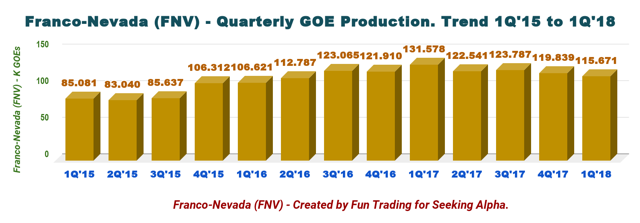

| Production gold equivalent Oz Eq. | 83,040 | 85,637 | 106,312 | 106,621 | 112,787 | 123,065 | 121,910 | 131,578 | 122,541 | 123,787 | 119,839 | 115,671 |

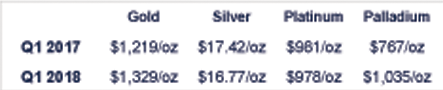

| Gold price | 1,193 | 1,124 | 1,104 | 1,181 | 1,259 | 1,335 | 1,218 | 1,219 | 1,257 | 1,278 | 1,257 | 1,329 |

Source: Company filings and Morningstar

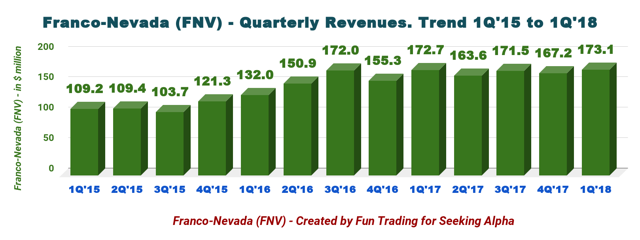

Trends And Charts: Revenues, Earnings Details, Free Cash Flow, Debt, And Production Details1 - Revenues

Sandip Rana, the CFO, said in the conference call:

The company achieved a number of financial records, which are all highlighted. The company did benefit from higher commodity prices during the quarter, particularly gold and oil, as well as benefiting from revenue generated by new oil and gas acquisitions we made over the last two years. And due to the lower-cost nature of our business model, recent commodity prices did have a significant impact on the company's EBITDA, margin and net income.

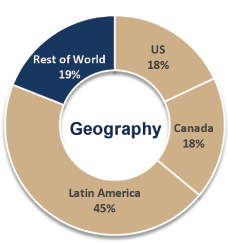

In the first quarter, revenues were a record $173.1 million. For 1Q'18, revenue was sourced 87.3% from precious metals (68.3% gold, 13.6% silver, and 5.4% PGM) and 80.6% from the Americas (44.5% Latin America, 17.7% U.S., and 18.4% Canada).

Source: FNV Presentation

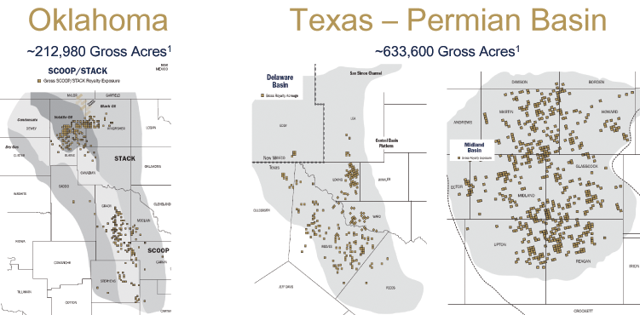

Note about the Delaware Oil & Gas Royalties: Franco-Nevada finalized the purchase of a royalty portfolio in Delaware, which represents the western portion of the larger Permian Basin in Texas for $101.3 million on February 20, 2018. The royalties are derived principally from a mineral title which provides a continued interest in royalty lands. The transaction has an effective date of October 1, 2017. Revenue in 1Q'18 included $1.3 million from the Delaware royalties.

2 - Free Cash Flow

Free cash flow for FNV was $137.8 million compared to $119.4 million the same quarter in 2017.

Note about Cobre Panama: Franco-Nevada funded the additional precious metals stream on the Cobre Panama project for $356.0 million on March 16, 2018. Franco-Nevada now has exposure to the precious metals produced from 100% of the ownership of the Cobre Panama project.

Furthermore, the company shows a robust capital availability.

Source: Presentation

3 - Production in Gold equivalent ounce and details

Gold equivalent production was lower compared to a year ago. The number of gold equivalent ounces from gold assets, excluding NPIs decreased year-over-year - which was in line with expectations - as the company expected a reduction in gold and silver ounces delivered from Candelaria, Guadalupe, and South Arturo in 2018.

Source: FNV Presentation

The reduction deliveries in Candelaria and South Arturo are temporary, and Franco-Nevada is expecting higher production in 2019 onwards. Total production was 115,671 Geos with 76.8% coming from gold.

For Q1 2018, operating margin is 80.8% per GEO or $1068/Oz. It is slightly higher year over year, due mostly to the fact that most of the production came from the stream as explained above.

A reminder on the oil & gas segment, Franco-Nevada acquired oil & gas assets for a total of $110 million.

Franco-Nevada agreed to acquire a package of royalties in the Midland Basin for a price of $110 million. The Midland Basin comprises the eastern portion of the broader Permian Basin, which is located in west Texas, and which is known to be one of the most active plays in North America.

During the 1Q'18, oil & gas revenue increased 74.3% year-over-year, reflecting the addition of the STACK, Midland, Orion, and Delaware royalties, higher prices and increased payments from Weyburn.

Source: FNV Presentation

Franco-Nevada has invested ~$340 million to date in its oil segment.

Guidance 2022The company expects an increase of production Geos of 17% from 2017 to 2022 and an increase in oil & gas revenues of 81% for the same period.

CommentaryDespite an evident business success, the stock strongly corrected after reaching a high of $86 in late November 2017 as I have been warning my followers about it, due to an overvalued and overbought situation.

From almost $86, FNV dropped to $67 in four months or a 22% haircut. However, since April, the stock recovered a little and seems trading at intermediate support now around $70 (buy flag).

Last year, I had indicated that "we own a large position in FNV and we decided to take some profit off the table at $84.75 early September when the RSI was flashing an overbought situation."

The good news is that we bought back most of it at or below $68 in March-April, and we may add more under $70 now (Buy flag).

The thesis is pretty simple. Franco-Nevada is the best streamer in this category, and its future growth and financial stability is the perfect example of what a long-term investor is expecting. However, as always, when it comes to gold stock, it is imperative to adopt a trading/investing strategy in correlation with the price of gold and silver.

I recommend now FNV as a Buy at $70.

Author's note: Do not forget to follow me on the gold sector. Thank you for your support; I appreciate it. If you find value in this article and would like to encourage such continued efforts, please click the "Like" button below as a vote of support. Thanks!

Disclosure: I am/we are long FNV.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No comments:

Post a Comment